CIP Match & Watchlists

Onboard more customers and address compliance requirements

SentiLink provides comprehensive data sources and flexible configuration to help you verify more customer identities

Increase approval rates

Verify more identities without step-ups, onboarding more customers and reducing customer friction.

Reduce operational costs

Match more identities to reduce unnecessary manual review and document verification.

Address compliance needs

Support fulfillment of anti-money laundering and counter terrorism financing requirements at account opening.

Comprehensive coverage

Verify more identities, including hard-to-verify populations.

SentiLink CIP Match utilizes data from credit bureaus, telecom companies, public records, utilities, and application data across SentiLink’s network to enable verification of more applicant identities. Coverage for:

Our data sources enable coverage of populations that can cause challenges for institutions:

- ITINs

- Randomly issued SSNs

- 18-24 Year Olds

- Immigrants

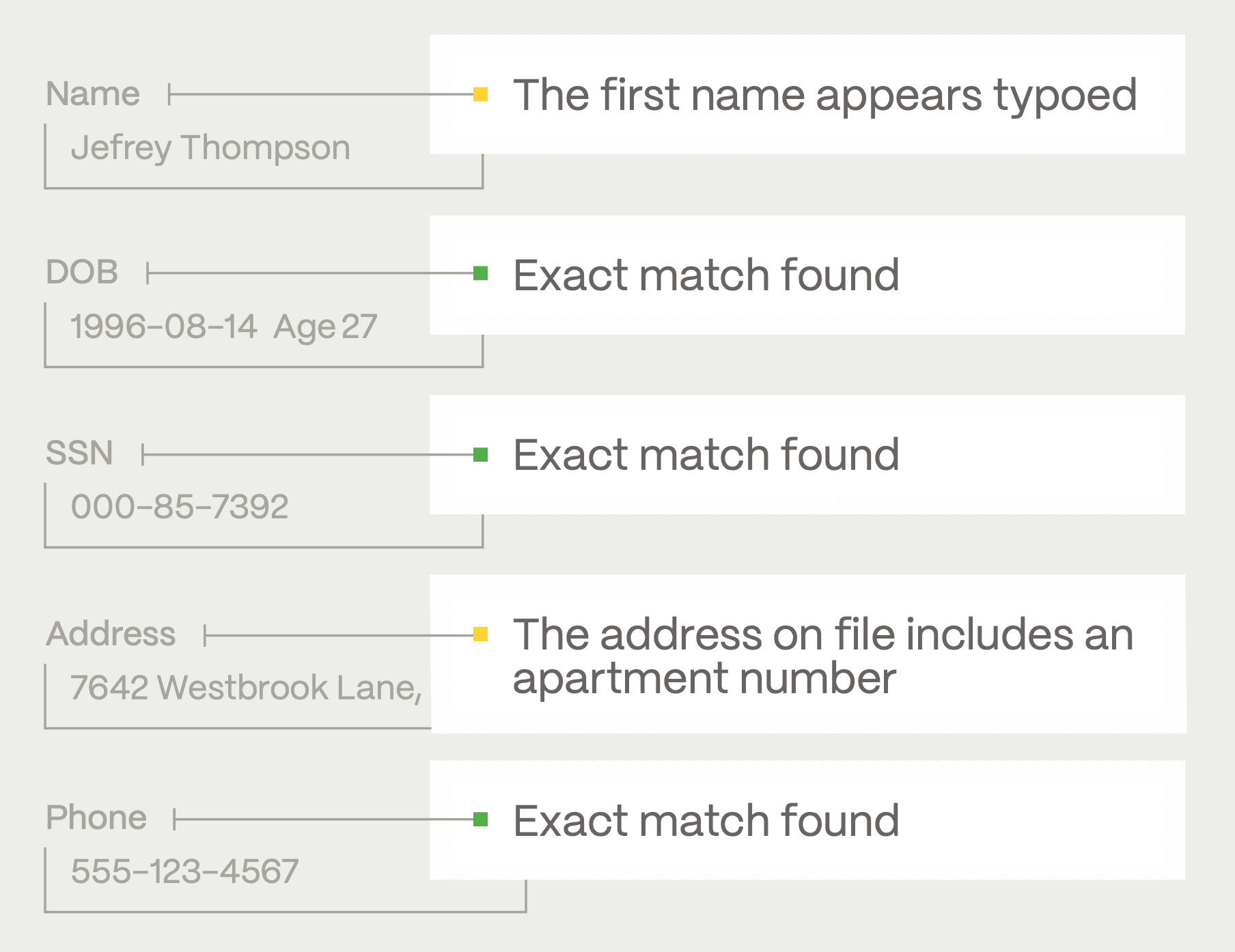

Balance risk and match rate

Maximize approvals using field matching scores

SentiLink scores application PII at a granular level, including phone number, returning scores depending on how well it matches our records. Your organization can utilize these scores to customize your definition of a successfully verified identity.

Common differences you can detect and verify with SentiLink:

- Typos

- Flipped month and day on DOB

- Different last name

- New address in the same city

- Phone number digit transposition

Download the data sheet

Learn more about how SentiLink can solve your organization's CIP and Watchlists needs

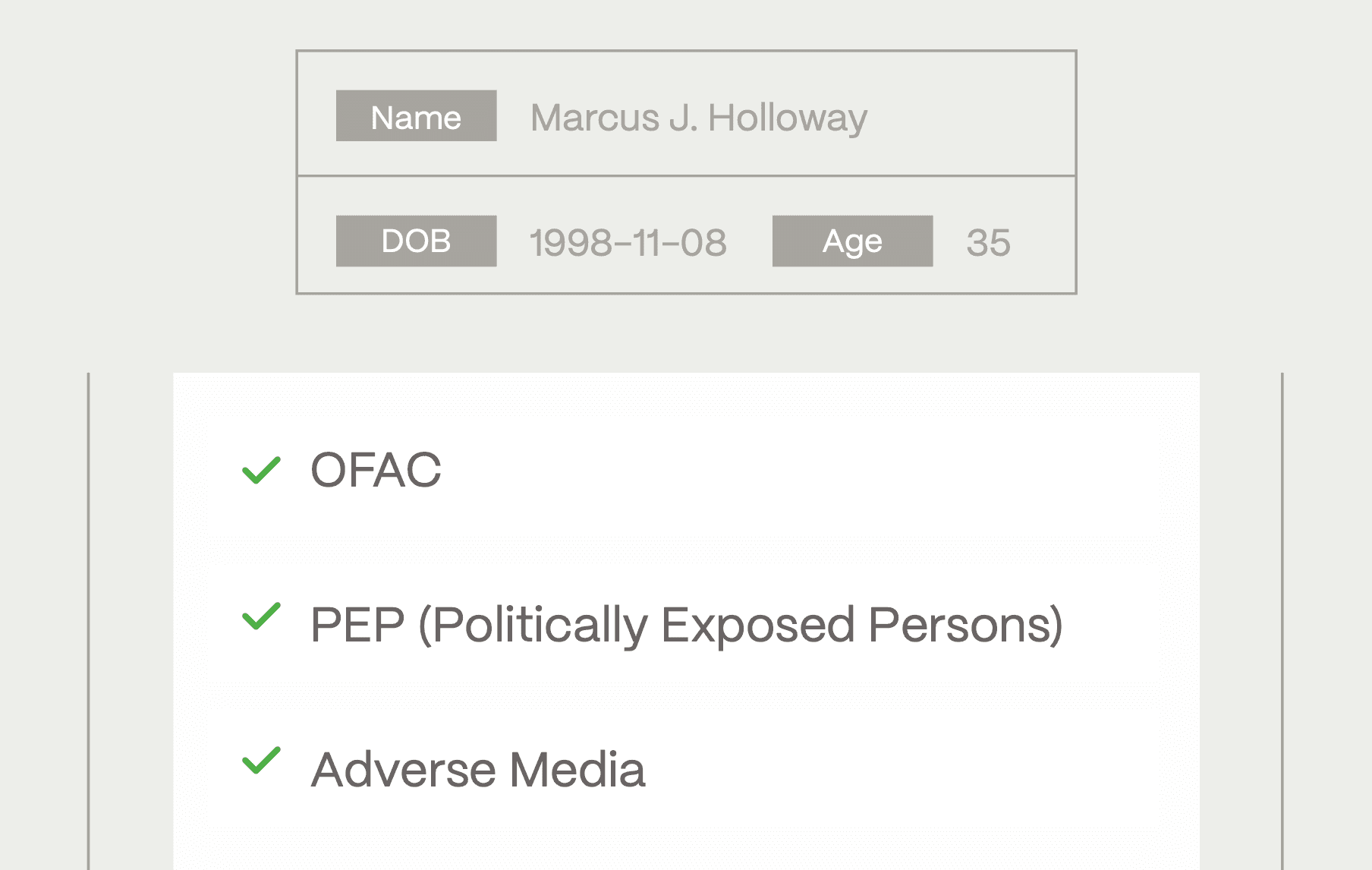

Compliance requirements

Address regulatory needs with our in-house OFAC sanctions list

SentiLink can screen applicants across all Watchlists using our in-house sanctions database. Coverage for:

-

OFAC -

PEP (Politically Exposed Persons) -

Adverse Media

While many solutions white label other providers, SentiLink has developed these capabilities to provide partners greater options for configuration and better support when investigations arise.

Insights

Route applications and enforce red-flag rules

SentiLink analyzes applicant information and provides clear, actionable signals for your team to detect, route, and triage high-risk applications